Please note that CEX.IO Card is currently available only to EEA residents.

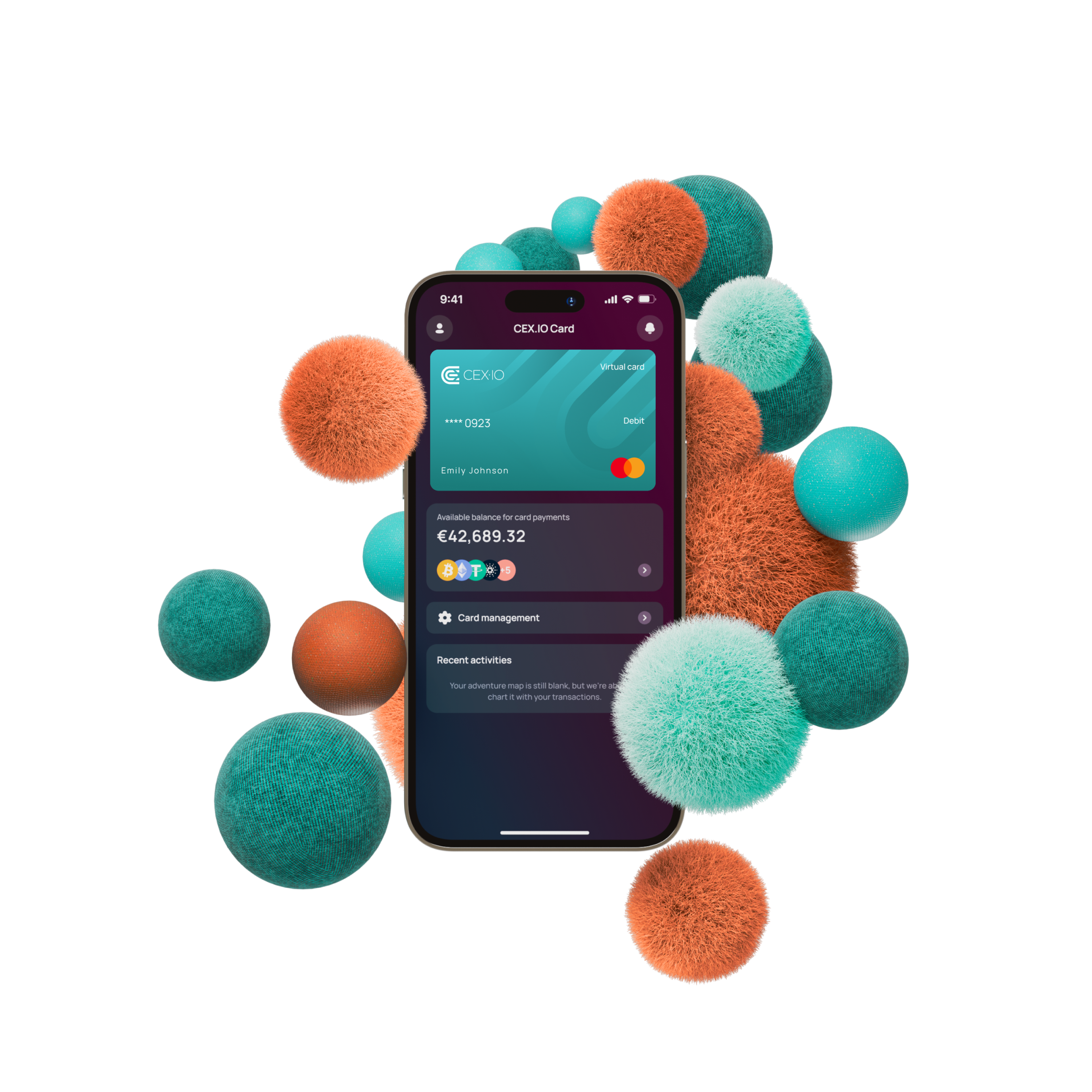

Crypto payments have never been so simple

Commission-free experience

Commission-free experience

Get your CEX.IO Card completely free. No annual or maintenance fees, as well zero fees for cross-border transfers.

Earn Crypto Cashback

Earn Crypto Cashback

Enjoy cashback in Bitcoin, Ethereum, DOGE, SOL, and other cryptocurrencies every time you pay with your CEX.IO Card

Add to Apple/Google Wallet

Add to Apple/Google Wallet

Enjoy paying with crypto for goods and services, as simple as cash.

Accepted in 150+ countries

Accepted in 150+ countries

CEX.IO Card offers a universal payment solution wherever you go.

Pay with your favorite crypto

Pay with your favorite crypto

Connect your portfolio to the CEX.IO Card and link up to four assets, ordered in preferred payment priority.

Welcome to the second phase of the crypto revolution!

“It’s been very exciting to see crypto hit the global mainstream. It’s now more straightforward than ever to buy, sell, and trade crypto assets. I remember the days when buying crypto was very difficult, and I decided to change that by launching CEX.IO in 2013. As pioneers in the industry, we were one of the first exchanges to allow you to purchase crypto with your debit and/or credit card. Since then, we’ve launched a whole ecosystem of groundbreaking products, including our spot exchange, staking, savings products, and more.

As I thought about the next wave in the crypto revolution and how to continue innovating, finding a way for our community to instantly spend crypto on everyday purchases is what came to mind. I spoke to many of our existing users and they agreed this is absolutely necessary. My team and I got to work on the CEX.IO Card, which allows you to effortlessly spend and earn crypto. I really hope you love the product, and would love to hear your feedback after launch. In the meantime, please download the CEX.IO App to be among the first to take advantage of the CEX.IO Card. Onward and upwards…

Want to claim your CEX.IO Card?

Download the CEX.IO App and join our ecosystem to be among the first to order it.

FAQ

What is a crypto debit card?

A crypto debit card offers a convenient bridge between decentralized and traditional finance, by allowing users to apply their digital assets toward everyday purchases, with minimal effort. For instance, CEX.IO Card is a debit card that empowers its holders to use 100+ digital assets to pay for goods and services instantly. It is accepted by over 30 million merchants in 150+ countries, where CEX.IO provides its services.

How do crypto debit cards work?

In terms of user experience, crypto debit cards resemble regular bank cards. However, unlike bank cards, they are linked to a crypto payment app, or wallet. CEX.IO Card grants users the ability to access their CEX.IO Wallet balance for in-person and online orders.

When a user makes a purchase with digital assets using their CEX.IO Card, they instantly convert into fiat currency, at the existing exchange rate. The converted fiat currency is then used to complete the transaction with the merchant, just like a traditional debit card.

Participants can monitor their CEX.IO Wallet balance, as well as link preferred assets to spend via CEX.IO Card by using our mobile app. Eligible users can also fund their crypto wallet, transfer, or buy crypto using various funding methods supported on CEX.IO.

What are the benefits of using a crypto debit card?

Using a crypto debit card such as CEX.IO Card offers several compelling benefits, including:

- Convenience — CEX.IO Card eliminates the need for crypto withdrawals by unlocking the ability to use these funds directly for common payments. With a CEX.IO Card, participants can use crypto to make everyday transactions instantly and effortlessly.

- Wide acceptance — CEX.IO Card is accepted by millions of merchants in almost every country. With CEX.IO Card, crypto value is no longer limited to peer-to-peer transactions and online payments.

- Automated conversion — Participants who elect to enhance their crypto journey with CEX.IO Card will no longer need to exchange crypto for fiat to make payments. Initiating transactions with CEX.IO Card automatically converts the selected digital assets at the best available price, allowing for seamless, instantaneous conversion.

- All-in-one payment app — Using crypto to pay for goods and services could require complex apps and services. Our mobile app offers a one-stop, intuitive crypto experience, and functions as a trusted pathway to transacting in a TradFi world via CEX.IO Card. Much like the ability to buy crypto with Google Pay, and use Google Pay to pay with crypto, CEX.IO Card also works in both directions.

How can I get a CEX.IO Card?

CEX.IO Card is currently only available for users from the European Economic Area (EEA), who’ve completed at least address verification on CEX.IO, and provided a phone number with two-factor authentication (2FA) enabled. However, please note that we are continuously working to provide CEX.IO Card access to a broader range of serviceable jurisdictions.

To claim a CEX.IO Card, download our mobile app (if you haven’t done so already), and follow these steps:

- Swipe left on the CEX.IO App homepage.

- Tap Claim your CEX.IO Card.

- Read and accept our Terms of Use.

- Select up to four (4) assets to use for payments (Euro is added by default).

- Set the currency priority for payments.

This process will unlock your CEX.IO Card. From there, It can be added to Google Pay and Apple Pay to make payments with your mobile device.

What are the security features for CEX.IO Card?

CEX.IO Card takes advantage of industry-leading security measures adopted within the CEX.IO ecosystem. These include two-factor authentication (2FA) at login and to authorize transactions, as well as biometric authentication to access CEX.IO App.

In addition, CEX.IO Card utilizes widely used card protection measures, such as PIN-code, 3DSecure, and CVV2. Users also have the ability to rapidly freeze/unfreeze linked cards for any reason.

What funding methods can I use to top up my CEX.IO Card?

CEX.IO Card utilizes the CEX.IO Wallet balance linked to the account to perform transactions. This means, any funding method available on CEX.IO for your jurisdiction may be used to deposit funds.

For instance, CEX.IO supports fiat deposits using Visa/Mastercard debit/credit card, Google/Apple Pay, bank transfers, and various online wallets. When it comes to crypto, CEX.IO enables 40+ blockchains and 100+ digital assets, with some featuring multichain support. Find more information about funding methods here.

If you don’t have crypto in your CEX.IO Wallet, digital assets may be purchased using one of the supported fiat payment methods. For instance, participants can choose to buy USDT using a SWIFT transfer, or buy Bitcoin with a credit card.

What are the payment limits for CEX.IO Card transactions?

Customers can pay up to €3,000 daily, and €10,000 monthly (or the equivalent in cryptocurrency) using their CEX.IO Card. There are currently no minimum requirements. Eligible participants can link up to four (4) digital assets to their Card. For greater flexibility, payment priorities may be changed at any time, as well as the set of linked assets. While integrated into our ecosystem, users are responsible for funding their CEX.IO Card. You can increase your CEX.IO Card balance by transferring funds to CEX.IO Wallet, or buying digital assets at CEX.IO.

What digital assets are supported with CEX.IO Card?

Any cryptocurrency available on CEX.IO may be paired with CEX.IO Card. CEX.IO features 100+ digital assets, from top-tier crypto (BTC, ETH) and stablecoins (USDT, USDC), to memecoins (DOGE, SHIB) and lower-cap altcoins (ATOM, UNI).

Users can transfer these assets via 40+ blockchains, and/or buy them via a wide array of funding methods. Some pathways included the opportunity to buy crypto with Apple Pay, debit/credit cards, bank transfers, and emerging peer-to-peer solutions.

Does using a CEX.IO Card affect my credit score?

No. CEX.IO Card is a debit card, which draws funds directly from funds stored in a linked CEX.IO Wallet. Transactions conducted with CEX.IO Card do not build credit, nor is spending activity reported to credit bureaus.

Who is the CEX.IO card issuer?

The CEX.IO Card is issued by our reputable financial partner, Quicko Sp. z o.o.

How does the CEX.IO Card Cashback 2.0 Promo work?

It's simple! Every time you use your CEX.IO Card to spend €1 or more, you'll receive a random crypto prize. The bigger your purchase, the bigger your potential reward.

How do I participate in the CEX.IO Card Cashback Offer?

If you don't have a CEX.IO Card yet, get yours today! Download the CEX.IO App, log in to your account or create a new one, swipe left and claim your card. Once you have your CEX.IO Card, just use it for your everyday purchases of €1 or more. You'll automatically be entered to receive cashback rewards.

When does the CEX.IO Card Cashback 2.0 Promo start and end?

The promotional period is May 1 to May 31, 2025. CEX.IO reserves the right to modify or terminate the promotion at any time. Check this page for updates.

How do I use my CEX.IO Card?

Your CEX.IO Card works just like a regular debit card. You can use it online or link it to Apple Pay or Google Pay for contactless payments in stores and cafes.

What are the benefits of using the CEX.IO Card?

The CEX.IO Card allows you to spend your crypto and traditional currencies easily, globally, and securely. It's accepted by millions of merchants worldwide and integrates seamlessly with the CEX.IO ecosystem.