CEX.IO Crypto Trading & Exchange API

Easily set up your CEX.IO API, start trading and make the most out of the crypto market opportunities.

Easily set up your CEX.IO API, start trading and make the most out of the crypto market opportunities.

May be increased by user request

CEX.IO provides free crypto API channels for cryptocurrency traders, which are some of the most commonly used APIs in the industry:

Trade crypto 24/7, even when you’re offline

Implement automated trading strategies

Obtain real-time and historical market data from the exchange

Place a variety of trading orders

Receive information about your account balance

Integrate trading bots and third-party trading terminals

Choose permissions you want to give and click on ‘Create API key’.

This information is necessary when connecting to your preferred trading platform. Once you activate the key, a secret will be hidden.

Click the Activate button on a dedicated page to finish the API setup process for your account.

A platform to connect all exchange accounts and wallets, so that users can manage their entire portfolio under a single outlet, and monitor the market in real-time.

With HaasOnline, users can develop, backtest, and deploy high-frequency crypto trade bots that can operate across dozens of different cryptocurrency exchanges.

Offers AI-driven market sentiment data to incorporate into trading bot algorithms.

A cryptocurrency trading platform that allows users to manage their accounts in more than 20 exchanges from a single interface.

A platform that offers a trading terminal, crypto trading bots, Telegram automation, and email signals that operates on top cryptocurrency exchanges.

An advanced multi-exchange crypto portfolio manager and trading platform, where users can trade on multiple exchanges from a single interface.

Make use of short-term price volatility to trade short-term trends. Purchase cryptocurrencies on sharp price declines or crashes; in other words, buy them at support levels and then sell them at resistance.

Benefit from the price disparities across two or more markets for the same asset. In that sense, arbitrage traders buy an asset in one crypto exchange, to sell the same asset for a higher price in a different exchange.

Capture the sentiment of the market with the use of API technology. With API trading, you can quickly retrieve sentiment data.

Profit from price deviations by opening short or long positions when the market price significantly deviates away from the volume-weighted average (VWAP).

Are you a skilled trader or market maker looking to tap into the vast potential of retail flow? Take your trading to the next level with our powerful API designed specifically for market makers like you.

Market entry year

Registered users

Cryptocurrency markets

Maker fee for $10M+ trading volumeSee fee schedule >

Just link your terminal to a broker’s automated trading system, which is typically a crypto exchange API, to execute quick and efficient trades. The exchange API allows you to code algorithmic trades that execute at hyperkinetic speeds.

Based on your code, algorithms can automaticallybuy cryptocurrency , or convert BTC to USDon a crypto trading platform, at a frequency that would be impossible with manual work.

A rate limit is the number of requests that you can send to an exchange per minute, from your terminal. The private rate limit for REST API on CEX.IO Exchange is 600 transactions every 10 minutes, while the public one is 300 transactions each 10 minutes. If using CEX.IO Spot Trading, API traders can take advantage of 100/200 requests per minute (public/private).

CEX.IO API can be used in multiple ways depending on what a trader wants to achieve. Here are some of the most common approaches to take advantage of CEX.IO API:

You do not need to do anything else. Just keep your API connection on the same device you used to set it up.

Yes, you can place it when you use Spot Trading. However, this feature is not supported on the legacy CEX.IO Exchange.

The suite of supported order types depends on what platform you use for API trading. On CEX.IO Exchange, you can use only Market and Limit orders to execute your trades.

On the other hand, CEX.IO Spot Trading features Market, Limit, and Stop Limit orders. One Cancels the Other (OCO) and Trailing Stop orders will be added soon. By default, Limit and Stop Limit orders follow Good Till Cancel (GTC) policy on Spot Trading. Additionally, traders may apply the Good Till Date (GTD) and Immediate Or Cancel (IOC) principles for Limit orders if necessary.

Yes, if you need to increase your rate limit, contact our support team via live chat.

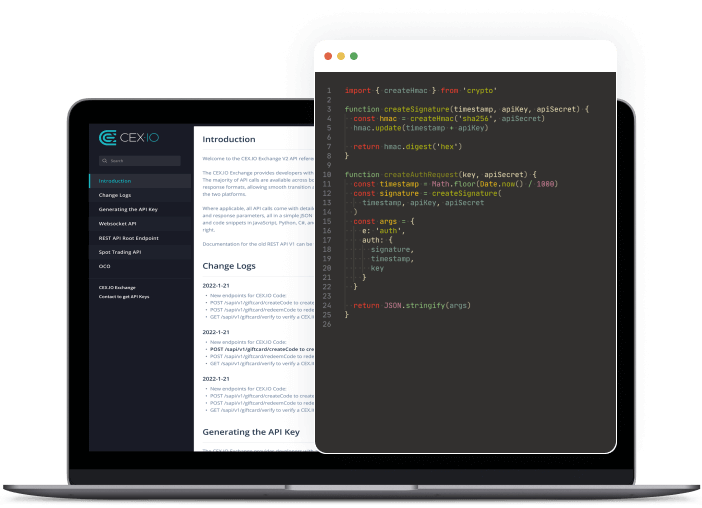

It’s very simple to use a crypto trading API on CEX.IO. Follow the five steps below to quickly set up and activate your API:

The REST API is better suited for dealing with your trade orders, while the WebSocket API is suited for both placing orders and retrieving market data. The WebSocket API provides three times more information per request than the REST API.

To make a crypto exchange API comparison, you can consult the algorithm repository of each available API channel on CEX.IO.